NVIDIA Earnings Date 2024: What To Expect + Analysis

Want to know if NVIDIA is on track to continue its reign as a tech behemoth? All eyes are on the horizon as NVIDIA, the undisputed titan of the GPU world, gears up to unveil its financial performance for 2024, and the announcement could trigger a seismic shift in the stock market. The highly anticipated reveal is slated for Thursday, May 9, 2024, after the market closes. Keep in mind, though, that this date is based on the company's historical patterns and is subject to the winds of change.

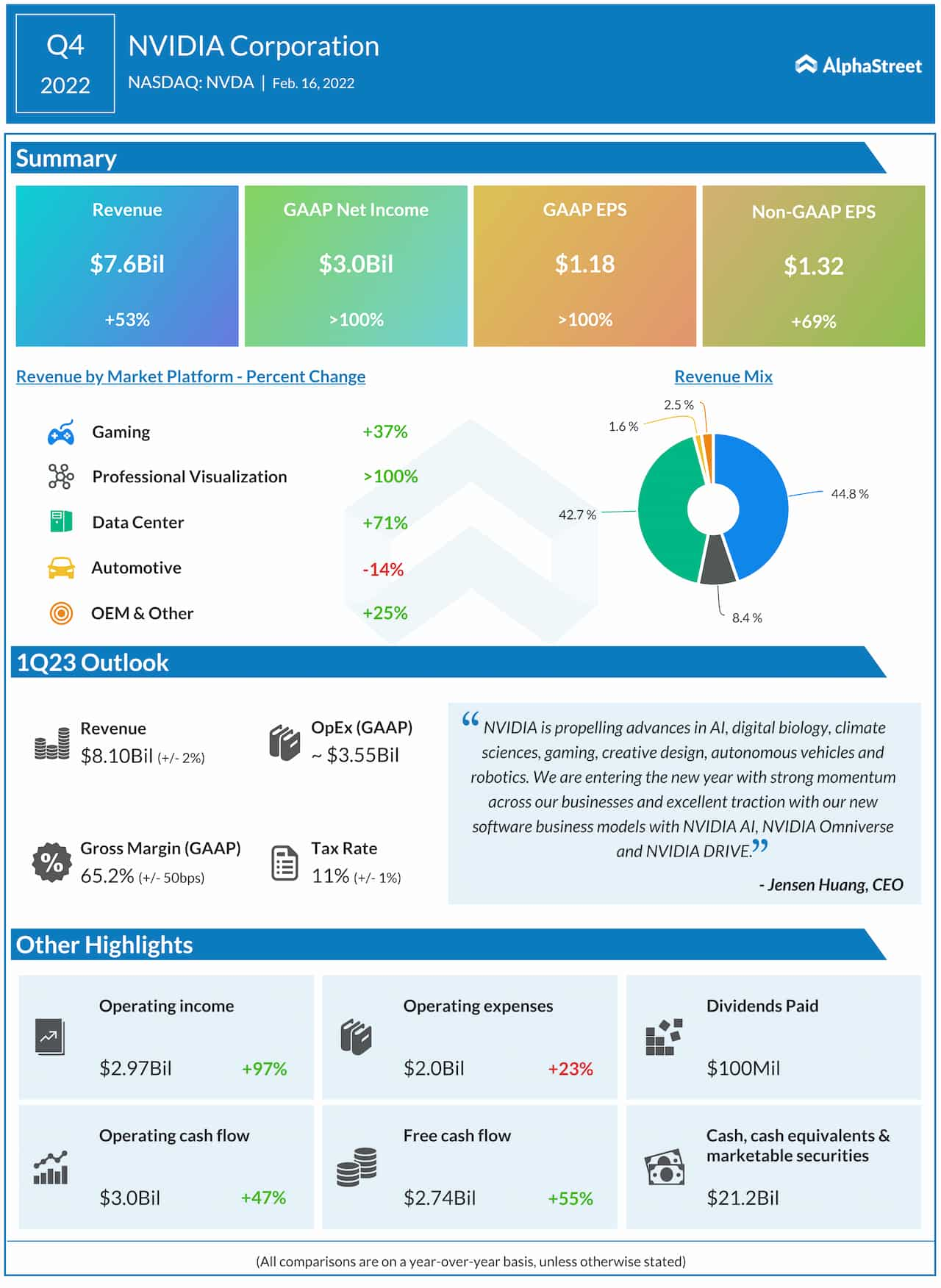

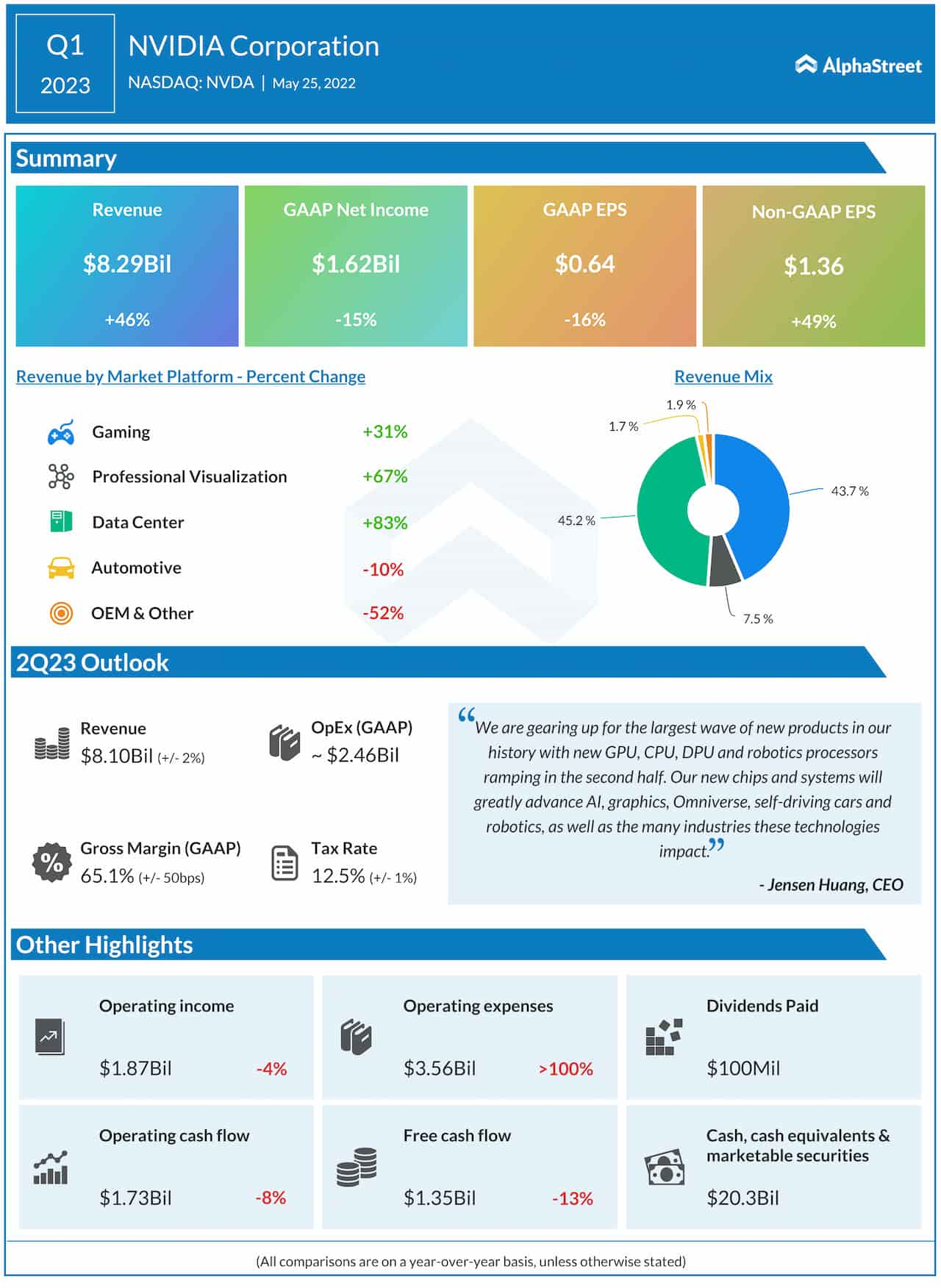

The NVIDIA earnings date is more than just a calendar entry; it's a red-letter day for financial professionals worldwide. Investors, analysts, and traders are all on tenterhooks, keen to dissect the company's financial guts. The earnings report serves as a crucial health check, providing insights into key performance indicators like revenue, earnings per share (EPS), gross margin, and operating expenses, each a vital sign of NVIDIA's overall health and future trajectory.

| NVIDIA Financials | |

|---|---|

| Expected Earnings Date | Thursday, May 9, 2024 (After Market Close) |

| Key Metrics | Revenue, Earnings per Share (EPS), Gross Margin, Operating Expenses |

| Primary Revenue Drivers | GPU Sales (Gaming, Data Center, Automotive) |

| Factors Influencing Earnings | Technology Industry Health, GPU Demand, Competition, Innovation |

| Stock Price Impact | Positive Earnings = Stock Price Increase; Disappointing Earnings = Stock Price Decrease |

| Official Investor Relations | NVIDIA Investor Relations |

NVIDIA's earnings date is more than just an information dump; it can act as a powerful catalyst, setting the stage for dramatic movements in its stock price. A stellar earnings report, brimming with robust revenue growth or an EPS that shatters expectations, can trigger a buying frenzy, sending the stock soaring. Conversely, a lackluster performance, with earnings falling short of targets, can spark a sell-off, plunging the stock into the red.

- Unlock Telegram Masa 49 Com Telegram Download Guide Year

- Tia Hernlens Rise Exploring Tia Hernlen 2024 Her Significance

For investors and traders, the golden rule is vigilance. The NVIDIA earnings date remains fluid, subject to potential revisions. Always cross-reference with the company's official investor relations website for the most current and accurate details.

NVIDIA's earnings date for 2024 is a pivotal juncture, a moment that casts light on the company's financial strength and future opportunities. Earnings results are carefully scrutinized by investors and traders, who leverage this information to gauge the company's health and make informed investment choices.

A closer inspection of NVIDIA's financial performance requires a deep dive into several key aspects:

- Vegamovies4u Your Guide To Free Movies Amp Tv Shows Is It Safe

- Pineapplebrat Fanfix What Fans Should Know Is It Safe

- Revenue: At its core, NVIDIA's revenue engine is fueled by the sales of its prized graphics processing units (GPUs). These GPUs power a diverse range of applications, from immersive gaming experiences to high-performance data centers and cutting-edge automotive technologies.

- Earnings per Share (EPS): EPS acts as a crucial barometer, quantifying the portion of the company's profit that is allocated to each outstanding common stock share. It's a key indicator of profitability on a per-share basis.

- Gross Margin: Gross margin serves as a measure of efficiency, revealing the percentage of revenue that remains after accounting for the direct costs associated with producing goods and services. It highlights how effectively NVIDIA manages its production expenses.

- Operating Expenses: Operating expenses encompass a broad range of costs, including investments in research and development (R&D), sales and marketing initiatives, and general administrative overhead. These expenses are essential for sustaining NVIDIA's growth and innovation.

NVIDIA's earnings performance is subject to a myriad of influencing factors. These include the general health of the technology sector, the ever-shifting demand for GPUs across key markets, and the intense competition from rival technology firms. Furthermore, the company's ability to continuously innovate and roll out groundbreaking products and technologies is a critical driver of its long-term success.

The link between the "nvidia earnings date 2024" and various factors is complex and multifaceted:

- Impact on Stock Price: NVIDIA's earnings date frequently has a dramatic effect on its stock price. Positive news tends to propel the stock upward, while disappointing results can trigger a downward spiral.

- Investor Sentiment: The earnings report furnishes investors with vital insights into NVIDIA's financial well-being and growth trajectory. This information shapes investment decisions and influences the overall perception of the company.

- Market Analysis: Market analysts leverage NVIDIA's earnings results to benchmark the company's performance against competitors and the broader technology landscape. This comparative analysis helps in assessing NVIDIA's relative strengths and weaknesses.

The link between the "nvidia earnings date 2024" and several key metrics is also crucial:

- Revenue Growth: NVIDIA's revenue growth is a primary indicator of its ability to capture market share and expand into new domains.

- Profitability: EPS and gross margin provide essential insights into NVIDIA's profitability and its effectiveness in managing expenses.

- Research and Development: NVIDIA's commitment to R&D is vital for developing pioneering products and technologies that underpin future expansion.

The NVIDIA earnings date for 2024, scheduled for May 9, 2024, represents a key event that sheds light on the company's financial state and prospects. Here are some vital considerations:

- Revenue Growth: The extent to which NVIDIA can capture market share and venture into new markets.

- Profitability: Insights into NVIDIA's profitability and operational efficiency, as reflected in EPS and gross margin.

- Research and Development: The crucial role of R&D investment in fostering new products and technologies.

- Investor Sentiment: How earnings outcomes influence investor attitudes and investment strategies.

- Stock Price Impact: The potential for positive earnings to drive stock prices upward, while disappointing results may lead to declines.

- Market Analysis: How analysts utilize earnings data to evaluate NVIDIA's performance relative to rivals and the industry as a whole.

- Future Growth: Clues about NVIDIA's capacity to sustain growth and adapt to evolving market forces.

These aspects are interwoven, offering a complete perspective on NVIDIA's financial health and growth potential. Robust revenue growth, profitability, and R&D investment signal a thriving and expanding entity. Positive investor sentiment and an appreciating stock price mirror market confidence in NVIDIA's future. By analyzing these elements collectively, investors and analysts can make well-informed decisions about NVIDIA's investment prospects.

Revenue growth is a critical yardstick for measuring NVIDIA's financial health and growth potential. The company's ability to secure market share and venture into fresh markets is paramount for maintaining revenue momentum and driving long-term profitability.

- Market Share: NVIDIA's capacity to expand its market share within existing sectors, such as gaming and data centers, is crucial for revenue expansion. The company's dedication to innovation and the creation of new products and technologies helps it preserve a competitive edge and attract new clients.

- New Markets: Venturing into new markets, including automotive and healthcare, provides NVIDIA with additional avenues for growth. The company's proficiency in AI and GPU technology positions it favorably to capitalize on the increasing demand for AI-powered solutions in these industries.

- Product Diversification: NVIDIA's diversification strategy, which spans various markets, lessens its dependence on any single market or product category. This approach aids in risk mitigation and presents opportunities for growth across diverse economic landscapes.

- Strategic Partnerships: NVIDIA's collaborative alliances with prominent technology firms, such as Microsoft and Amazon, grant access to new markets and distribution channels. These alliances can accelerate revenue expansion and broaden NVIDIA's reach.

Strong revenue growth is a promising indicator for investors, signifying the company's ability to implement its growth strategy and seize market opportunities. Consistent revenue gains can result in enhanced profitability, higher earnings per share, and an escalating stock price.

Profitability is a key determinant of NVIDIA's financial performance, closely scrutinized by investors and analysts during earnings releases. EPS (earnings per share) and gross margin are two essential metrics that offer insights into NVIDIA's profitability and efficiency.

EPS represents the allocation of the company's profit to each outstanding common stock share. A higher EPS typically signals stronger profitability per share, which is generally seen as favorable by investors. Factors affecting EPS include revenue growth, cost management, and share repurchase programs.

Gross margin quantifies the percentage of revenue remaining after deducting the cost of goods sold. A higher gross margin reflects efficient cost management and greater profitability from sales. Factors affecting gross margin include product mix, pricing strategies, and manufacturing costs.

Both EPS and gross margin are vital in assessing NVIDIA's profitability and efficiency. Robust profitability enables the company to invest in growth initiatives, research and development, and return capital to shareholders through dividends or share buybacks.

During earnings releases, NVIDIA's profitability metrics are under close observation. Positive EPS and gross margin results may indicate a healthy and growing company, while disappointing results might raise concerns about its ability to generate profits and sustain growth.

Research and development (R&D) forms the bedrock of NVIDIA's long-term growth strategy. The company dedicates substantial resources to R&D to create new products and technologies that drive innovation and unlock new markets.

Strong R&D investment is crucial for NVIDIA to maintain its competitive advantage in the rapidly evolving technology industry. Its R&D focus has led to groundbreaking products, like the GeForce RTX series of graphics cards and the NVIDIA DRIVE platform for autonomous vehicles.

The link between R&D investment and NVIDIA's earnings date is significant. Successful R&D endeavors can yield new product and technology launches, stimulating revenue growth and enhancing profitability. This can positively impact NVIDIA's earnings and stock price.

For instance, NVIDIA's R&D investment in artificial intelligence (AI) and machine learning has resulted in new AI-powered products and services. These offerings are in high demand across various industries, including gaming, healthcare, and automotive, contributing to NVIDIA's overall earnings.

Furthermore, NVIDIA's R&D efforts have driven cost efficiencies and improved product quality. By investing in R&D, NVIDIA can refine manufacturing processes and lower production costs, potentially leading to higher profit margins and greater overall profitability.

In summary, NVIDIA's R&D investment is a critical driver of its growth and profitability. Strong R&D spending can lead to the development of transformative products and technologies, boosting revenue and improving earnings. Consequently, investors and analysts closely monitor NVIDIA's R&D spending during earnings releases to assess the company's long-term growth prospects.

The NVIDIA earnings date for 2024 is eagerly anticipated by investors, as it provides insights into the company's financial health and growth prospects. Investor sentiment plays a pivotal role in shaping market responses to NVIDIA's earnings.

Positive earnings, marked by strong revenue growth or EPS exceeding expectations, can spark a surge in investor confidence, driving up NVIDIA's stock price as investors grow more optimistic about future growth. Conversely, disappointing earnings can trigger sell-offs and stock price declines as investors worry about the company's ability to sustain growth and profitability.

Investor sentiment is shaped by factors such as the health of the technology industry, the competitive environment, and the company's success in executing its growth strategy. Strong investor sentiment can give NVIDIA access to capital and bolster long-term growth plans. A positive reputation among investors can also aid in attracting and retaining talented employees and partners.

For investors, understanding the link between NVIDIA's earnings date and investor sentiment is crucial for informed decision-making. By tracking earnings and gauging investor sentiment, investors can position themselves to capitalize on opportunities or mitigate risks.

The NVIDIA earnings date for 2024 is closely watched by investors and traders due to its potential to impact the company's stock price. Positive earnings, like strong revenue growth or better-than-expected EPS, can boost investor confidence and demand for NVIDIA stock, potentially driving up the stock price for investors who bought shares prior to the announcement.

On the other hand, disappointing earnings can have the opposite effect. If NVIDIA's earnings fall short, investors may worry about future growth and sell their shares, leading to a stock price decline and losses for investors who bought shares earlier.

The stock price impact of NVIDIA's earnings is a key consideration for investors, as it can affect their portfolio significantly. Understanding the connection between the earnings date and potential stock price changes allows investors to make informed decisions about buying, selling, or holding NVIDIA stock.

In short, the NVIDIA earnings date for 2024 is a crucial event with potential to significantly impact the company's stock price. Positive earnings can lift the stock, while disappointing results may cause it to fall. Investors should carefully weigh the potential stock price impact when making investment decisions about NVIDIA.

The NVIDIA earnings date for 2024 is a significant event for market analysts, as it provides insights into the company's financial performance and competitive position. Analysts use these results to evaluate NVIDIA's performance relative to its competitors and the wider tech industry.

By comparing NVIDIA's earnings with those of its competitors, analysts can identify patterns that reveal the company's strengths and weaknesses. For example, if NVIDIA's revenue growth exceeds that of its competitors, it may indicate market share gains or successful execution of its growth strategy. Conversely, lower profit margins compared to competitors may suggest competitive pressures or operational inefficiencies.

Analysts also use NVIDIA's earnings results to assess the company's performance within the broader tech industry. By comparing growth rates, profitability metrics, and market share to industry benchmarks, they can determine whether NVIDIA is keeping pace or lagging behind. This analysis helps investors understand NVIDIA's competitive standing and growth potential.

In summary, the connection between "Market Analysis: Analysts use earnings results to assess NVIDIA's performance relative to competitors and the industry." and "nvidia earnings date 2024" is crucial for investors and analysts seeking to understand the companys financial health, competitive position, and growth prospects. Analyzing NVIDIA's earnings alongside its competitors and the industry allows analysts to provide valuable insights to help investors make informed decisions.

The NVIDIA earnings date for 2024 is a significant event providing insights into the company's ability to sustain growth and adapt to changing market dynamics. By analyzing NVIDIA's earnings results, investors and analysts can better understand the company's long-term growth prospects and its ability to navigate the evolving technology landscape.

- Revenue Growth Potential: NVIDIA's earnings results provide insights into its ability to sustain revenue growth in both existing and new markets. Strong revenue growth indicates successful execution of its growth strategy, market share gains, and expansion into new areas of opportunity.

- Profitability and Efficiency: The earnings results also shed light on NVIDIA's profitability and efficiency. Healthy profit margins and cost controls indicate efficient operation and strong cash flow, providing NVIDIA with the resources to invest in future growth.

- Research and Development (R&D) Investment: NVIDIA's earnings results provide insights into its R&D investment. Strong R&D spending is crucial for maintaining its competitive edge and developing new products and technologies, indicating commitment to innovation and long-term growth.

- Market Position and Competitive Advantage: The earnings results provide insights into NVIDIA's market position and competitive advantage. Analyzing NVIDIA's performance relative to its competitors helps investors and analysts assess its strengths, weaknesses, and ability to adapt to changing market dynamics.

Overall, the connection between "Future Growth: Earnings results provide insights into NVIDIA's ability to sustain growth and adapt to changing market dynamics." and "nvidia earnings date 2024" is crucial for investors and analysts seeking to understand NVIDIA's long-term growth prospects and investment potential. Analyzing NVIDIA's earnings results in the context of these key facets enables informed decisions about the company's future and its potential to deliver sustainable growth and returns.

This section addresses common questions and concerns regarding NVIDIA's earnings date for 2024, providing informative answers to assist investors and analysts in their decision-making.

Question 1: When is NVIDIA's earnings date for 2024?

NVIDIA's earnings date for 2024 is scheduled for Thursday, May 9, 2024, after the market closes. As this date is subject to change, consulting NVIDIA's official investor relations website for the most up-to-date information is advisable.

Question 2: What key metrics should investors focus on during NVIDIA's earnings announcement?

Key metrics to consider during NVIDIA's earnings announcement include revenue growth, earnings per share (EPS), gross margin, operating expenses, and research and development (R&D) investment. These metrics provide insights into the company's financial performance, profitability, and future growth prospects.

Summary: Understanding NVIDIA's earnings date and key metrics is essential for investors and analysts to make informed decisions. By monitoring NVIDIA's financial results and analyzing them in the context of the company's growth strategy and competitive landscape, investors can gain valuable insights into NVIDIA's long-term potential.

- Who Is Lexi Thompsons Husband All About Cody Matthew Now

- Discover Vega Movie Nl Your Guide To Dutch Streaming

Nvidia Earnings Date 2024 Timed Vonni Johannah

Nvidia Q1 Earnings 2024 Date Kelsy Mellisa

Nvidia Earnings 2024 Q2 Date Britta Cortney