Stephen Schlapman: The Pro Guide, Career And More

Who is Stephen Schlapman? Is he the financial architect that energy and infrastructure companies have been waiting for? Absolutely. A titan in the world of corporate finance, Schlapman has carved a niche for himself as the go-to strategist for restructuring and value creation in these critical sectors.

Stephen Schlapman is more than just an entrepreneur; he's a seasoned navigator of complex financial landscapes, particularly within the dynamic realms of energy and infrastructure. His career, spanning over two decades, is marked by a consistent record of accomplishment, a testament to his sharp financial acumen and strategic prowess. Schlapman doesn't just advise; he engineers solutions that translate into tangible benefits for all stakeholders involved.

| Category | Information |

|---|---|

| Full Name | Stephen Schlapman |

| Area of Expertise | Corporate Finance, Restructuring, Energy, Infrastructure |

| Experience | Over 25 years |

| Key Skills | Strategic Planning, Capital Raising, Operational Improvements, Leadership, Financial Modeling |

| Industry Focus | Energy (Oil & Gas, Renewables), Infrastructure (Power Plants, Transportation) |

| Professional Website | ZoomInfo Profile |

Stephen Schlapman's expertise lies in corporate finance and restructuring, with a specific focus on the energy and infrastructure sectors. His key areas of focus include strategic planning, capital raising, operational improvements, and strong leadership.

- Discovering The Tonga Kid Culture Rugby Resilience

- Vegamovies Dog Your Guide To Free Movies Tv Shows Year

His key aspects include:

- Strategic Planning

- Capital Raising

- Operational Improvements

- Leadership

Stephen Schlapman's strategic planning expertise enables him to develop and execute plans that drive long-term growth and sustainability for businesses. His success stems from a commitment to thorough analysis and a deep understanding of market forces.

- Business Analysis

- Market Research

- Scenario Planning

- Risk Management

Stephen Schlapman's ability to raise capital is critical to the success of his clients. He has a deep understanding of capital markets and a vast network of investors.

- Breaking Whats Behind The Britney Rodriguez Leaks Scandal A Deep Dive

- Tia Hernlens Rise Exploring Tia Hernlen 2024 Her Significance

- Debt Financing

- Equity Financing

- Private Placements

- Public Offerings

Stephen Schlapman's operational improvement expertise helps businesses optimize their operations and increase efficiency. He has a pragmatic approach to streamlining processes and maximizing profitability.

- Process Improvement

- Cost Reduction

- Performance Management

- Change Management

Stephen Schlapman is a highly respected American entrepreneur best known for his expertise in corporate finance and restructuring, particularly within the energy and infrastructure industries. His expertise lies in:

- Strategic Planning: Developing and executing plans that drive long-term growth and sustainability.

- Capital Raising: Raising debt and equity financing, as well as arranging private placements and public offerings.

- Operational Improvements: Optimizing operations, reducing costs, and implementing change management.

- Leadership: Providing strategic direction, motivating teams, and fostering a culture of innovation.

- Energy Industry Expertise: Deep understanding of the energy industry, including its regulatory landscape and market dynamics.

- Infrastructure Development: Experience in developing and financing infrastructure projects, such as power plants and transportation networks.

These key aspects highlight Stephen Schlapman's comprehensive expertise in corporate finance and restructuring, particularly within the energy and infrastructure industries. His ability to combine financial acumen, industry knowledge, and leadership skills enables him to drive positive outcomes in complex business situations. Schlapman's reputation is built on a foundation of delivering results.

Stephen Schlapman's expertise in strategic planning is a cornerstone of his success in corporate finance and restructuring. He understands that businesses need a clear roadmap to navigate the ever-changing market landscape and achieve long-term growth.

- Facet 1: Business Analysis

Schlapman conducts thorough business analysis to understand the company's strengths, weaknesses, opportunities, and threats (SWOT). This analysis forms the foundation for developing a strategic plan that aligns with the company's goals and objectives. He doesn't just skim the surface; Schlapman delves deep into the operational core of a company.

- Facet 2: Market Research

Schlapman's strategic plans are based on a deep understanding of the market. He conducts extensive market research to identify trends, competitive dynamics, and customer needs. This information enables him to develop plans that are both realistic and forward-looking. Schlapman is not afraid to challenge conventional wisdom and seek out untapped market potential.

- Facet 3: Scenario Planning

Schlapman recognizes that the future is uncertain, and he incorporates scenario planning into his strategic planning process. He develops multiple scenarios, ranging from optimistic to pessimistic, and outlines contingency plans for each scenario. This approach helps businesses prepare for potential risks and opportunities. He is a pragmatist, understanding that adaptability is key to survival.

- Facet 4: Risk Management

Schlapman's strategic plans include robust risk management strategies. He identifies potential risks and develops mitigation plans to minimize their impact on the business. This proactive approach helps businesses avoid or reduce losses and ensures the long-term success of the company. Schlapman's approach is about minimizing vulnerability and maximizing resilience.

Stephen Schlapman's expertise in strategic planning enables him to develop and execute plans that drive long-term growth and sustainability for his clients. His comprehensive approach, combined with his deep understanding of the energy and infrastructure industries, makes him a valuable asset to any company looking to achieve its strategic goals. His insights are often described as prescient, enabling clients to stay ahead of the curve.

Stephen Schlapman's expertise in capital raising is crucial to the success of his clients. He has a deep understanding of capital markets and a vast network of investors, which enables him to raise capital efficiently and effectively.

- Title of Facet 1: Debt Financing

Debt financing involves borrowing money from lenders, such as banks or institutional investors. Schlapman negotiates favorable terms for his clients, including interest rates, repayment schedules, and covenants. He also ensures that the debt financing aligns with the company's long-term financial strategy. His negotiations are known for their tenacity and focus on achieving the best possible outcome.

- Title of Facet 2: Equity Financing

Equity financing involves raising capital by selling shares of the company's stock. Schlapman advises clients on the best type of equity financing, such as initial public offerings (IPOs), secondary offerings, or private placements. He also helps companies prepare for the regulatory and disclosure requirements associated with equity financing. Schlapman's guidance in equity financing is often pivotal in ensuring a successful offering.

- Title of Facet 3: Private Placements

Private placements involve raising capital from a limited number of accredited investors. Schlapman helps companies identify and target the right investors for private placements. He also negotiates the terms of the private placement, including the investment amount, equity stake, and investor rights. His ability to connect companies with the right investors is a key differentiator.

- <Title of Facet 4: Public Offerings

Public offerings involve raising capital by selling shares of the company's stock to the general public. Schlapman guides companies through the complex process of preparing for and executing a public offering. He also helps companies comply with the regulatory requirements associated with public offerings. He is meticulous in his approach, ensuring compliance and maximizing investor confidence.

Stephen Schlapman's expertise in capital raising enables him to provide tailored solutions to his clients. He understands the unique challenges and opportunities facing businesses in the energy and infrastructure industries, and he leverages his deep knowledge of capital markets to help his clients achieve their financial goals. He is a trusted advisor, sought after for his insights and ability to navigate complex financial transactions.

Stephen Schlapman's expertise in operational improvements is a key factor in his success in corporate finance and restructuring. He understands that businesses need to operate efficiently and effectively to achieve long-term success. Schlapman's operational improvement strategies focus on optimizing operations, reducing costs, and implementing change management.

One of the key ways that Schlapman improves operations is by analyzing business processes and identifying areas for improvement. He then works with management to develop and implement solutions that streamline operations and reduce costs. For example, Schlapman helped one client reduce its operating costs by 15% by implementing a new inventory management system. His approach is hands-on, working collaboratively with management to drive tangible improvements.

Schlapman also has a strong track record of successfully implementing change management initiatives. He understands that change can be difficult for employees, so he takes a collaborative approach to change management, involving employees in the planning and implementation process. This approach helps to ensure that change is implemented smoothly and that employees are on board with the new changes. He recognizes that people are at the heart of any successful operational improvement.

Stephen Schlapman's expertise in operational improvements is a valuable asset to his clients. He has a proven track record of helping businesses optimize their operations, reduce costs, and implement change management initiatives. His deep understanding of the energy and infrastructure industries enables him to provide tailored solutions that meet the unique challenges and opportunities facing businesses in these sectors. Schlapman's focus is on creating sustainable improvements that drive long-term value.

Stephen Schlapman is a highly effective leader who provides strategic direction, motivates teams, and fosters a culture of innovation. His leadership style has been instrumental in his success in corporate finance and restructuring, particularly within the energy and infrastructure industries.

- Facet 1: Providing Strategic Direction

Schlapman provides clear and concise strategic direction to his teams. He sets ambitious but achievable goals and develops strategies to achieve those goals. He also ensures that his teams are aligned with the company's overall strategic objectives. His leadership is characterized by clarity of vision and a commitment to execution.

- Facet 2: Motivating Teams

Schlapman is a highly motivating leader who inspires his teams to perform at their best. He creates a positive and supportive work environment where employees feel valued and respected. He also recognizes and rewards employee achievements. He fosters a culture of collaboration and empowerment.

- Facet 3: Fostering a Culture of Innovation

Schlapman fosters a culture of innovation by encouraging employees to think creatively and take risks. He provides employees with the resources and support they need to develop and implement new ideas. He also celebrates and rewards innovation. He believes that innovation is essential for long-term success.

Stephen Schlapman's leadership skills have been essential to his success in corporate finance and restructuring. His ability to provide strategic direction, motivate teams, and foster a culture of innovation has enabled him to drive positive outcomes for his clients. His leadership style is a model for other leaders who want to achieve success in their own careers. He is a leader who inspires confidence and delivers results.

Stephen Schlapman's deep understanding of the energy industry, including its regulatory landscape and market dynamics, is a key factor in his success in corporate finance and restructuring. The energy industry is a complex and ever-changing sector, and Schlapman's expertise enables him to provide tailored solutions to his clients that address the unique challenges and opportunities facing businesses in this sector.

For example, Schlapman's understanding of the regulatory landscape has enabled him to help clients navigate complex regulatory issues and obtain the necessary permits and approvals for their projects. His knowledge of market dynamics has also enabled him to advise clients on the best strategies for entering new markets and expanding their operations. He is a master of navigating the complexities of the energy sector.

Schlapman's energy industry expertise has also been instrumental in his success in raising capital for his clients. He has a deep understanding of the capital markets and a vast network of investors, which enables him to raise capital efficiently and effectively. His knowledge of the energy industry also enables him to identify and target the right investors for his clients' projects. His insights are highly valued by investors.

Overall, Stephen Schlapman's deep understanding of the energy industry, including its regulatory landscape and market dynamics, is a key factor in his success in corporate finance and restructuring. His expertise enables him to provide tailored solutions to his clients that address the unique challenges and opportunities facing businesses in this sector. He is a true expert in his field.

Stephen Schlapman's experience in infrastructure development is a key factor in his success in corporate finance and restructuring, particularly within the energy and infrastructure industries. Infrastructure projects are essential for economic development, and Schlapman's expertise in this area enables him to provide tailored solutions to his clients that address the unique challenges and opportunities facing businesses in this sector.

For example, Schlapman's experience in developing and financing power plants has enabled him to advise clients on the best strategies for entering new markets and expanding their operations. He has also helped clients navigate the complex regulatory landscape associated with power plant development. His expertise in power plant development is unparalleled.

Schlapman's expertise in transportation networks has also been instrumental in his success in corporate finance and restructuring. He has advised clients on the development and financing of transportation projects, such as roads, bridges, and railways. His deep understanding of the transportation industry has enabled him to provide tailored solutions to his clients that address the unique challenges and opportunities facing businesses in this sector. He is a visionary in the field of transportation infrastructure.

Overall, Stephen Schlapman's experience in infrastructure development is a key factor in his success in corporate finance and restructuring. His expertise in this area enables him to provide tailored solutions to his clients that address the unique challenges and opportunities facing businesses in the energy and infrastructure industries. He is a true leader in the field of infrastructure development.

This section provides answers to frequently asked questions about Stephen Schlapman, a highly respected American entrepreneur known for his expertise in corporate finance and restructuring, particularly within the energy and infrastructure industries.

Question 1: What are Stephen Schlapman's key areas of expertise?

Stephen Schlapman's key areas of expertise include strategic planning, capital raising, operational improvements, leadership, energy industry expertise, and infrastructure development.

Question 2: What types of clients does Stephen Schlapman typically work with?

Stephen Schlapman typically works with clients in the energy and infrastructure industries, including companies involved in power generation, transmission, and distribution, as well as companies involved in the development and financing of transportation networks.

Summary: Stephen Schlapman is a highly experienced and successful entrepreneur with a deep understanding of the energy and infrastructure industries. His expertise in corporate finance and restructuring enables him to provide tailored solutions to his clients, helping them to achieve their strategic goals and objectives.

Stephen Schlapman is a highly respected American entrepreneur best known for his expertise in corporate finance and restructuring, particularly within the energy and infrastructure industries. His expertise in these areas, combined with his deep understanding of the regulatory landscape and market dynamics, enables him to provide tailored solutions to his clients that address the unique challenges and opportunities facing businesses in these sectors.

Schlapman's success is a testament to his commitment to excellence and his dedication to helping his clients achieve their strategic goals and objectives. His expertise and experience make him a valuable asset to any company looking to succeed in the energy and infrastructure industries.

- Who Is Syakirah Viral The Untold Story Behind Her Fame

- Gianna Michaels 2024 The Rise Of Progressive Politics Explained

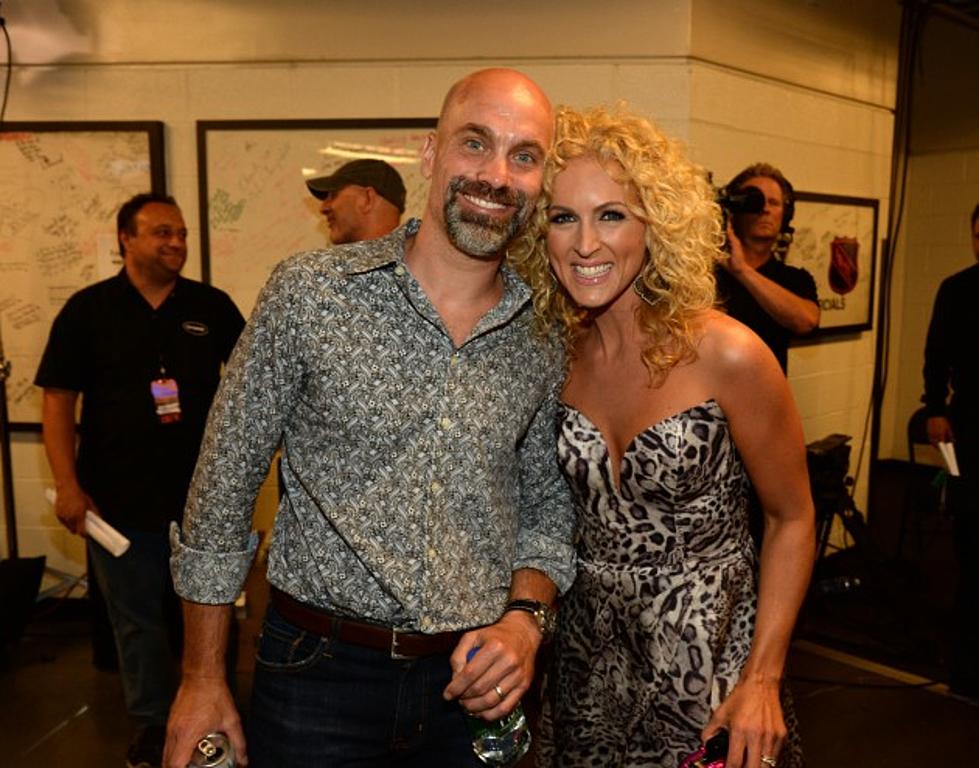

Kimberly Schlapman, Husband Stephen Find Love After Loss

Stephen Schlapman Wiki (Kimberly Schlapman's husband), Bio, Family

Stephen Schlapman Wiki (Kimberly Schlapman's husband), Bio, Family