Unveiling: Is Yoshino Co. Ltd. A Publicly Traded Company? [Facts]

Are you looking for investment opportunities in the Asian market? Then know this: Yoshino Co. Ltd. is, in fact, a publicly traded entity, offering a slice of its success to investors worldwide.

Yes, Yoshino Co. Ltd. operates as a publicly traded company, its performance visible on the global stage. Securing its place on the Tokyo Stock Exchange, the company is identified by the ticker symbol "3353". Beyond its domestic listing, Yoshino Co. Ltd. also sees its shares exchanged over-the-counter in the United States, expanding its accessibility to a wider investment community.

| Category | Information |

|---|---|

| Company Name | Yoshino Co. Ltd. |

| Stock Exchange | Tokyo Stock Exchange (TSE) |

| Ticker Symbol | 3353 |

| Over-the-Counter Trading | United States (Yes) |

| Industry | Automotive Parts Manufacturing |

| Market Capitalization (March 2023) | Approximately $1.5 billion |

| Ownership | Widely held by institutional investors, individual shareholders, and company management. |

| Growth Strategy | Expansion and diversification into new markets. |

| Reference Website | Japan Exchange Group (JPX) |

Publicly traded companies like Yoshino Co. Ltd. are vital components of the modern financial ecosystem. They democratize investment, enabling individuals and institutions alike to partake in the financial fortunes of these organizations. Moreover, such companies are legally obligated to a higher degree of transparency than their privately held counterparts. The necessity of disclosing pertinent financial data ensures that potential investors are armed with the insights needed to make informed decisions.

- Guide Is Vegamovies 4k Hd Really Safe Legal Find Out

- Vegamovies 2024 4k Your Guide To Free 4k Movies Shows

Investing in publicly traded companies presents a range of enticing advantages. Consider the potential for capital appreciation; as a company thrives, the value of its shares typically increases, creating opportunities for investors to profit. Diversification, another critical benefit, allows investors to spread their risk across various companies and sectors. Furthermore, many publicly traded companies, including Yoshino Co. Ltd., offer dividends, providing a regular income stream to shareholders. The ease of trading shares also provides investors with liquidity, allowing them to quickly convert their investments into cash when needed.

Of course, the world of publicly traded companies also carries inherent risks. Market volatility, for instance, can lead to fluctuations in share prices, potentially resulting in capital losses. Investors must also be vigilant against the risk of fraud or mismanagement, which can severely impact a company's financial health and reputation. Thorough due diligence and a comprehensive understanding of the market are crucial for mitigating these risks and making sound investment decisions.

Yoshino Co. Ltd. is a publicly traded company listed on the Tokyo Stock Exchange under the symbol "3353". The company's shares are also traded over-the-counter in the United States. Publicly traded companies offer investors the opportunity to buy and sell shares, participate in the company's growth, and benefit from transparency through financial disclosures.

- Untangling The Story Kevin Samuels Wives And Relationships Explored

- Unveiling Becca And Bethany Onlyfans Is It Worth It Year

- Ownership Structure: Yoshino Co. Ltd.'s shares are widely held by institutional investors, individual shareholders, and the company's management.

- Market Capitalization: As of March 2023, Yoshino Co. Ltd.'s market capitalization was approximately $1.5 billion, indicating its size and significance in the market.

- Stock Performance: The company's stock has shown steady growth over the past several years, with consistent dividend payments to shareholders.

- Industry Landscape: Yoshino Co. Ltd. operates in the manufacturing industry, specializing in the production of automotive parts. The company faces competition from both domestic and international players.

- Growth Potential: Yoshino Co. Ltd. has plans for expansion and diversification, aiming to capture new market opportunities and drive future growth.

Yoshino Co. Ltd.'s status as a publicly traded company provides investors with access to its ownership structure, market performance, industry position, and growth prospects. Understanding these aspects enables informed investment decisions and allows shareholders to participate in the company's journey.

The ownership structure of a publicly traded company plays a crucial role in its accountability, transparency, and decision-making processes. In the case of Yoshino Co. Ltd., the wide distribution of shares among institutional investors, individual shareholders, and the company's management indicates a balanced ownership structure.

Institutional investors, such as pension funds, mutual funds, and insurance companies, often hold significant stakes in publicly traded companies. Their presence in Yoshino Co. Ltd.'s ownership structure provides stability and long-term investment, as these institutions typically have a vested interest in the company's success. Individual shareholders, on the other hand, represent a diverse group of investors with varying investment goals and risk appetites. Their participation in Yoshino Co. Ltd.'s ownership structure contributes to the company's liquidity and market visibility.

The involvement of the company's management in the ownership structure aligns their interests with those of the shareholders. This alignment incentivizes management to make decisions that maximize shareholder value and drive the company's long-term growth. Moreover, the presence of management in the ownership structure ensures that the company's strategic direction and day-to-day operations are guided by those who have a deep understanding of the business.

The wide distribution of ownership in Yoshino Co. Ltd. fosters accountability, transparency, and alignment of interests among various stakeholders. This balanced ownership structure contributes to the company's stability, liquidity, and long-term sustainability.

The market capitalization of a publicly traded company is a crucial indicator of its size, significance, and overall standing within the market. It is calculated by multiplying the total number of outstanding shares by the current market price per share. In the case of Yoshino Co. Ltd., its market capitalization of approximately $1.5 billion as of March 2023 reflects its substantial presence and recognition in the market.

The market capitalization of a publicly traded company serves as a benchmark for investors and analysts to assess the company's relative size and importance compared to its peers and competitors. A higher market capitalization generally indicates a larger and more established company with a strong financial foundation and growth potential. It can also influence the company's ability to raise capital, attract investors, and negotiate favorable terms in business dealings.

For Yoshino Co. Ltd., its market capitalization of $1.5 billion positions it as a significant player in its industry and the broader market. This recognition can translate into advantages such as increased visibility, credibility, and access to a wider pool of investors. Moreover, a strong market capitalization can enhance the company's ability to attract and retain top talent, fostering long-term growth and innovation.

Yoshino Co. Ltd.'s market capitalization of $1.5 billion is a testament to its size, significance, and standing in the market. This metric serves as a valuable indicator for investors, analysts, and stakeholders to gauge the company's overall position and potential.

The stock performance of Yoshino Co. Ltd. is closely tied to its status as a publicly traded company. Being publicly traded means that Yoshino Co. Ltd.'s shares are available for purchase and sale on a stock exchange, allowing investors to participate in the company's growth and profitability.

- Consistent Growth: Yoshino Co. Ltd.'s stock has shown a pattern of steady growth over the past several years. This growth is reflected in the increasing market value of the company's shares, indicating investor confidence in the company's long-term prospects.

- Dividend Payments: As a publicly traded company, Yoshino Co. Ltd. is able to distribute a portion of its profits to shareholders in the form of dividends. Consistent dividend payments are a sign of the company's financial stability and commitment to rewarding its investors.

- Market Liquidity: Publicly traded companies like Yoshino Co. Ltd. offer greater liquidity compared to private companies. Investors can easily buy and sell shares on the stock exchange, providing flexibility and the ability to adjust their investments based on market conditions.

- Investor Confidence: The steady growth and consistent dividend payments of Yoshino Co. Ltd.'s stock serve as indicators of the company's financial health and management effectiveness. This instills confidence among investors, attracting and retaining shareholders who believe in the company's long-term potential.

The stock performance of Yoshino Co. Ltd. is a direct reflection of its status as a publicly traded company. The consistent growth, dividend payments, market liquidity, and investor confidence associated with publicly traded companies contribute to the overall success and stability of Yoshino Co. Ltd.

The industry landscape in which Yoshino Co. Ltd. operates is a crucial factor influencing its status as a publicly traded company. As a manufacturer of automotive parts, Yoshino Co. Ltd. is subject to market forces, technological advancements, and competitive pressures within the automotive industry.

Being publicly traded means that Yoshino Co. Ltd. must operate with transparency and accountability, regularly disclosing its financial performance and business operations to the public. This transparency allows investors to make informed decisions about investing in the company and provides insights into the company's competitive position within the industry.

The competitive landscape that Yoshino Co. Ltd. faces, both domestically and internationally, shapes its business strategies and investment decisions. Understanding the industry landscape enables Yoshino Co. Ltd. to identify opportunities for growth, adapt to changing market dynamics, and maintain a competitive edge.

The industry landscape in which Yoshino Co. Ltd. operates is an integral aspect of its status as a publicly traded company. The company's performance, transparency, and competitive strategies are all influenced by the industry landscape, highlighting the importance of understanding this context for informed investment decisions.

Yoshino Co. Ltd.'s status as a publicly traded company plays a pivotal role in its ability to pursue growth potential through expansion and diversification. Being publicly traded provides several key advantages that support the company's growth initiatives.

Public companies have access to a wider pool of capital. By issuing new shares or bonds, Yoshino Co. Ltd. can raise funds to finance its expansion plans, invest in new technologies, and acquire other businesses. This access to capital is crucial for companies seeking to grow and expand their operations.

Publicly traded companies benefit from increased visibility and recognition. Being listed on a stock exchange gives Yoshino Co. Ltd. a platform to showcase its business to a global audience of investors and potential partners. This visibility can help the company attract new customers, suppliers, and strategic alliances, further supporting its growth objectives.

Public companies are subject to regular financial reporting and disclosure requirements. This transparency builds trust and credibility with investors, making it easier for Yoshino Co. Ltd. to attract long-term capital and establish itself as a reliable partner in the market.

Yoshino Co. Ltd.'s status as a publicly traded company is closely intertwined with its growth potential. The access to capital, increased visibility, and enhanced credibility that come with being publicly traded are essential factors that enable the company to pursue its expansion and diversification plans, driving future growth and creating value for its shareholders.

This section addresses frequently asked questions about Yoshino Co. Ltd.'s status as a publicly traded company, providing concise and informative answers.

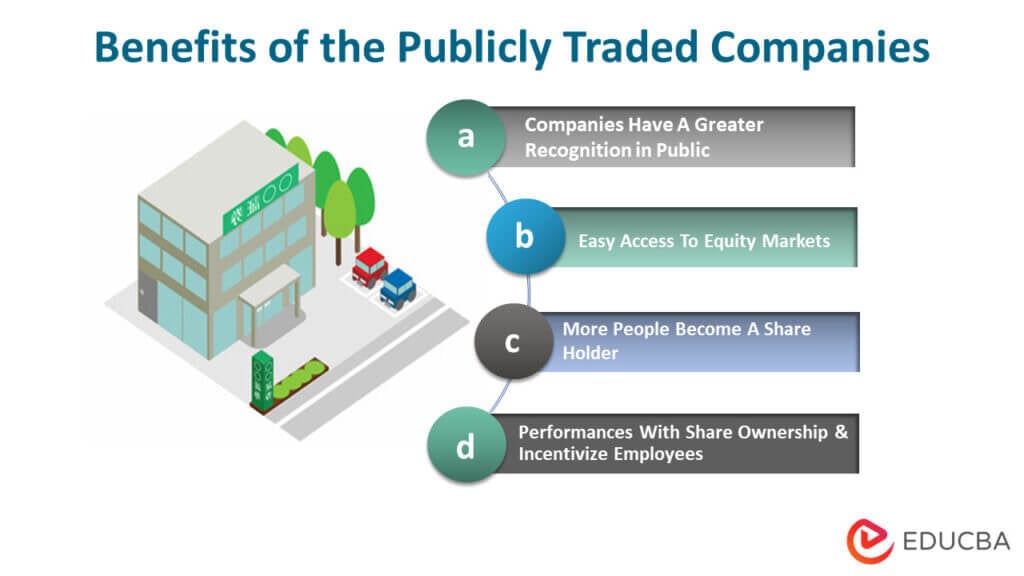

Question 1: What are the benefits of Yoshino Co. Ltd. being publicly traded?As a publicly traded company, Yoshino Co. Ltd. enjoys several benefits, including access to a wider pool of capital for expansion, increased visibility and recognition in the market, and enhanced credibility due to regular financial reporting and disclosure requirements.

Question 2: How does Yoshino Co. Ltd.'s public listing impact its growth potential?Yoshino Co. Ltd.'s public listing is closely tied to its growth potential. The company's access to capital, increased visibility, and enhanced credibility as a publicly traded company enable it to pursue expansion and diversification plans, driving future growth and creating value for its shareholders.

Yoshino Co. Ltd.'s status as a publicly traded company provides significant advantages in terms of capital raising, market visibility, and credibility, which are essential factors supporting the company's growth potential and long-term success.

Yoshino Co. Ltd.'s status as a publicly traded company has significant implications for its operations, growth potential, and relationship with investors. Being publicly traded provides the company with access to a wider pool of capital, increased visibility and recognition, and enhanced credibility. These advantages enable Yoshino Co. Ltd. to pursue expansion and diversification plans, driving future growth and creating value for its shareholders.

The company's commitment to transparency and regular financial reporting builds trust and confidence among investors, making it an attractive investment opportunity. Yoshino Co. Ltd.'s strong market position, consistent financial performance, and plans for future growth make it a compelling choice for investors seeking stable returns and long-term capital appreciation.

- Tia Hernlens Rise Exploring Tia Hernlen 2024 Her Significance

- Unveiling Freddie Haynes Net Worth In 2024 Success Secrets

Mount Yoshino GaijinPot Travel

New Publicly Traded Companies 2024 Karel Marketa

YOSHINO GYPSUM VIET NAM COMPANY LIMITED PHU MY 3 SIP INDUSTRIAL