Understanding NVIDIA Earnings Time: What Investors Need To Know Now

Is the tech world holding its breath? Absolutely. NVIDIA's earnings time is far more than just a financial report; it's a barometer of the entire technology landscape. The stakes are astronomically high.

NVIDIA earnings time signifies the period when NVIDIA Corporation, a behemoth in the world of graphics processing units (GPUs), unveils its financial performance for the quarter. This is not merely a procedural announcement; it's a closely monitored event by investors, financial analysts, and industry observers globally. The data released offers profound insights into NVIDIA's operational efficacy, overall revenue generation, and profitability metrics, thereby influencing market sentiments and investment strategies across the board.

| Aspect | Description |

|---|---|

| Company | NVIDIA Corporation |

| Industry | Semiconductors, Graphics Processing Units (GPUs), Artificial Intelligence |

| Earnings Release Schedule | Typically after market close on a Thursday, quarterly |

| Key Metrics Reported | Revenue, Earnings Per Share (EPS), Gross Margin, Forward-Looking Guidance |

| Importance | Provides insight into company's financial health, market trends, and future prospects |

| Reference | NVIDIA Official Website |

The relevance of NVIDIA's earnings time extends beyond the company's internal affairs. Firstly, it equips investors with critical information necessary to gauge the company's economic resilience and make informed choices regarding their investments. Secondly, analysts utilize the provided data to meticulously evaluate NVIDIA's developmental trajectory, subsequently issuing recommendations to their clientele. Thirdly, the broader financial community capitalizes on this period to assess the general health of the technology sector, using NVIDIA as a significant indicator.

- Guide Is Vegamovies 4k Hd Really Safe Legal Find Out

- Dakota Lovell The Complete Guide To Nba Star Dakota Lovell

The proceedings during NVIDIA's earnings time usually involve a well-structured dissemination of information. Following the market's closure on a given Thursday, the company issues a press release detailing its financial results. This is complemented by a conference call during which NVIDIA executives engage with analysts, further elucidating the reported figures and answering pertinent questions. Key financial metrics, such as revenue, earnings per share (EPS), and gross margin, are rigorously scrutinized. Moreover, NVIDIA offers forward-looking guidance, which is essentially a forecast of the company's expected performance in the upcoming quarter. Investors rely heavily on this guidance to make projections about the company's future trajectory and potential.

NVIDIA's ascent to prominence in recent years has amplified the significance of its earnings time. As one of the world's foremost semiconductor firms, NVIDIA's GPUs are integral to a diverse range of applications, spanning gaming, data centers, and the burgeoning field of artificial intelligence. Consequently, the financial community, from seasoned investors to budding analysts, pays particularly close attention to NVIDIA's earnings reports. These reports serve as a crucial bellwether, offering insights into the overall performance and future direction of the tech industry.

At the core of understanding NVIDIA's earnings performance are several key aspects, each offering a unique perspective on the company's financial standing and future potential.

- Vegamovies4u Your Guide To Free Movies Amp Tv Shows Is It Safe

- Tia Hernlens Rise Exploring Tia Hernlen 2024 Her Significance

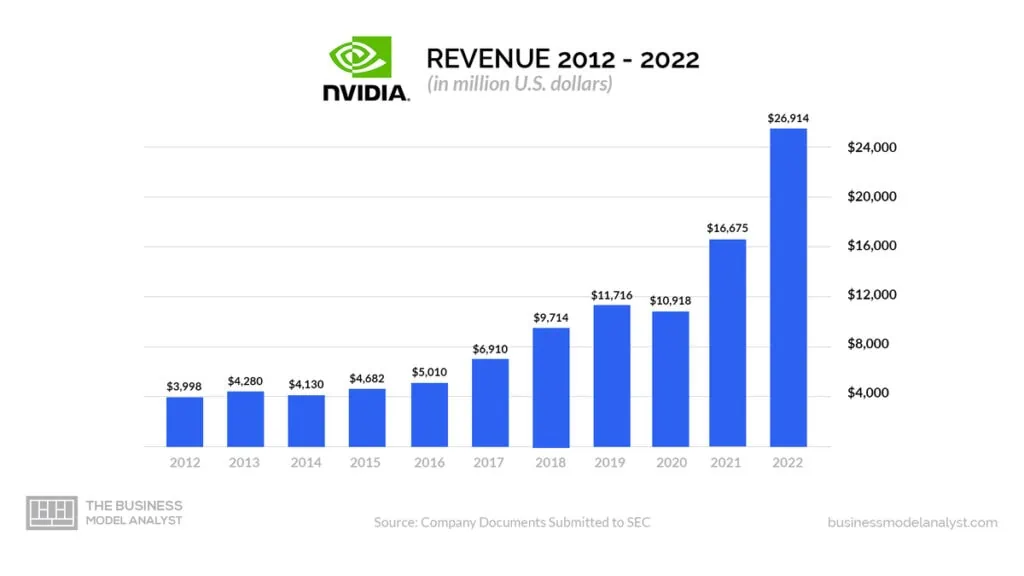

Revenue represents the aggregate income NVIDIA derives from its product sales and service provisions. It is a principal metric reflecting the company's overall fiscal condition, warranting close examination from investors. A steady and increasing revenue stream indicates a robust demand for NVIDIA's offerings and a solid foothold in the market.

Earnings Per Share (EPS) provides a measure of NVIDIA's profitability on a per-share basis. This is derived by dividing the company's net earnings by the total number of outstanding shares of common stock. EPS serves as a critical indicator for shareholders, reflecting the profitability attributable to each share they own. A rising EPS trend suggests that the company is becoming more efficient in generating profit for its shareholders.

Gross margin indicates the proportion of revenue that exceeds the cost of goods sold (COGS). It is calculated by dividing the gross profit (revenue minus COGS) by the total revenue. Gross margin is instrumental in evaluating NVIDIA's operational efficiency and pricing strategies. A high gross margin implies that the company is adept at managing its production costs and is successful in selling its products at a premium.

Forward-looking guidance, which NVIDIA provides, is an estimate of its financial performance for the next quarter. These projections are based on current market conditions and internal assessments. Investors use this guidance to predict the company's future financial health and make informed investment decisions. However, these forward-looking statements come with inherent uncertainties and should be evaluated cautiously.

The significance of NVIDIA earnings time is multifaceted. Firstly, it provides investors with a condensed overview of NVIDIA's economic status, which is pivotal in formulating judicious investment strategies. The released financial statements enable a detailed assessment of the company's strengths, weaknesses, opportunities, and threats.

Secondly, the data emanating from NVIDIA earnings time serves as a crucial resource for analysts to gauge the company's progress and issue recommendations to their clients. These recommendations influence investment decisions and market trends, underlining the importance of accurate and timely analysis.

Thirdly, NVIDIA earnings time offers the financial community at large an opportunity to take the pulse of the technology sector. This is especially relevant given NVIDIA's leadership role in key technology domains, from gaming to artificial intelligence.

NVIDIA earnings time is a red-letter event for anyone with a stake in the financial markets, technology industry, or the future of innovation. It's more than a numbers game; it's a story about technological advancement, market dynamics, and the ever-evolving landscape of global economics.

NVIDIA earnings time is an event that commands the attention of investors, analysts, and financial professionals alike. The insights it provides regarding the companys financial health, sales, and profitability are indispensable for making informed decisions in the market.

- Revenue: The aggregate value of sales stemming from the company's products and services.

- Earnings Per Share (EPS): Profit allocated to each outstanding share of common stock.

- Gross Margin: The percentage of revenue exceeding the cost of goods sold, indicating profitability.

- Forward-Looking Guidance: Projections and estimates provided by the company regarding future financial performance.

- Analyst Expectations: Market estimates and consensus forecasts provided by financial analysts.

- Market Reaction: The movement of NVIDIAs stock price following the earnings release.

Collectively, these elements present a holistic view of NVIDIAs financial standing, shifts in industry trends, and potential future outcomes. By carefully analyzing revenue growth, EPS performance, and gross margin trends, investors can effectively evaluate NVIDIAs financial stability and potential for growth. Forward-looking guidance offers a peek into the company's expectations for the forthcoming quarter, while analyst predictions reflect prevailing market sentiment. Finally, the markets reaction serves as an indicator of investor confidence and the companys position within the wider industry.

Revenue plays a pivotal role during NVIDIA earnings time as it has a direct influence on the company's financial outcomes. Revenue is derived from the sale of NVIDIAs various products and services, including graphics processing units (GPUs), gaming consoles, and data center solutions. Robust revenue growth signifies healthy demand for NVIDIA's products, thus positively impacting the companys overall financial performance.

For example, NVIDIA reported revenue of $8.29 billion in its fiscal year 2023 first quarter, which represented a noteworthy increase compared to both the previous quarter and year-over-year figures. This increase in revenue was largely fueled by strong demand for NVIDIA's GPUs from customers in the gaming, data center, and automotive sectors. As a result, this revenue growth played a significant role in NVIDIAs overall earnings growth and subsequently boosted its stock price.

Monitoring revenue trends during NVIDIA earnings time allows investors and analysts to gain insight into the company's financial wellbeing, its market share, and its competitive edge within the industry. It aids in evaluating the companys ability to generate income and spur growth. Furthermore, revenue performance can influence NVIDIAs investments in research and development, its product development roadmap, and its broader strategic decisions.

Earnings per share (EPS) is an essential metric used to evaluate a companys profitability and overall financial health. Within the context of NVIDIA earnings time, EPS offers specific insights into the company's capacity to generate earnings on a per-share basis.

- EPS Calculation: EPS is determined by dividing a company's net income by the total number of common shares outstanding. This metric represents the portion of a companys profitability that is allocated to each share of common stock.

- EPS Growth: Consistent EPS growth suggests that a company is successfully increasing its earnings per share over time. Such growth can be driven by various factors, including increased revenue, enhanced cost efficiency, or a reduction in the number of outstanding shares.

- EPS Impact on Stock Price: EPS growth can have a positive impact on a company's stock price. As investors typically value companies with higher earnings per share, a strong EPS performance can bolster investor confidence and thereby increase demand for a companys stock.

- EPS and Market Expectations: A company's EPS performance is often juxtaposed with analyst estimates and market expectations. Exceeding these expectations can positively influence the stock price, whereas falling short of expectations may lead to a decline in share value.

Analyzing EPS during NVIDIA earnings time yields valuable insights into the companys overall performance, its profitability, and its financial health. This analysis aids investors and analysts in evaluating NVIDIA's ability to generate earnings, assessing its competitive position, and making informed investment choices.

Gross margin is a critical metric that reveals NVIDIA's profitability and cost management effectiveness. It indicates the percentage of revenue remaining after deducting the cost of goods sold (COGS) from total revenue.

- Cost Structure: Gross margin is significantly impacted by NVIDIAs underlying cost structure, including manufacturing costs, material expenses, and labor costs. A higher gross margin typically suggests that NVIDIA is effectively managing its costs.

- Pricing Strategy: Gross margin is also influenced by NVIDIAs pricing approach. Higher prices can lead to improved gross margins, while lower prices may result in decreased margins.

- Product Mix: The specific combination of products sold by NVIDIA can also affect its gross margin. Products with higher margins contribute more significantly to the overall gross margin, while those with lower margins may have a dilutive effect.

- Competitive Landscape: The competitive environment in which NVIDIA operates can have a bearing on gross margin. Heightened competition can pressure prices, which, in turn, can reduce gross margin.

By analyzing the gross margin during NVIDIA earnings time, analysts and investors can gain valuable insights into the company's cost structure, pricing strategies, product distribution, and positioning within the competitive landscape. This analysis aids in evaluating NVIDIA's ability to generate profits, assessing its efficiency in managing costs, and making well-informed investment decisions.

Forward-looking guidance, typically presented during NVIDIA's earnings calls, is of significant importance because it provides insights into the company's anticipated performance for the upcoming quarter. This guidance serves as a crucial tool for both investors and analysts, enabling them to make informed decisions and evaluate NVIDIA's future prospects.

- Accuracy and Reliability: The precision of NVIDIA's forward-looking guidance is of utmost importance. Accurate guidance fosters trust and confidence among investors, while consistent inaccuracy can undermine credibility and lead to skepticism.

- Market Expectations: NVIDIA's forward-looking guidance is often compared against market expectations and analysts' estimates. Meeting or surpassing these benchmarks can have a positive impact on stock prices, whereas falling short can lead to a stock price decline.

- Impact on Investment Decisions: Forward-looking guidance plays a key role in shaping investment strategies. Optimistic guidance can encourage investors to either purchase or retain NVIDIA shares, while pessimistic guidance may prompt them to sell or reduce their positions.

- Risk and Opportunity Assessment: This guidance allows investors to evaluate potential risks and opportunities by offering insights into NVIDIAs projected revenue, expenses, and overall profitability, thereby aiding them in making sound investment decisions.

The analysis of forward-looking guidance during NVIDIA's earnings releases provides invaluable insight into the companys strategic direction, financial planning, and general outlook. It helps analysts and investors to gauge NVIDIA's confidence in its future performance, evaluate its competitive positioning, and make well-informed investment choices.

Analyst expectations are a pivotal factor in influencing the market's response to NVIDIAs earnings release. These expectations, rooted in analyst research and industry insights, act as benchmarks against which NVIDIA's actual financial results are assessed.

- Accuracy and Impact: The accuracy of analysts expectations has a direct influence on the markets reaction to NVIDIAs earnings reports. Consistently accurate expectations enhance the credibility of these analysts, whereas persistent inaccuracies can erode trust.

- Market Sentiment: Analyst expectations reflect the prevailing sentiment in the market regarding NVIDIAs prospects. Positive expectations can stimulate a bullish environment, attracting buyers and potentially driving up the stock price. Conversely, negative expectations can lead to a bearish outlook, encouraging selling and placing downward pressure on the stock price.

- Investment Decisions: Investors often leverage analyst expectations to inform their investment decisions. Expectations that align with or exceed NVIDIAs actual results can strengthen investor confidence and encourage them to hold or buy the stock. Conversely, expectations that fall short may trigger sell-offs or discourage new investments.

- Company Valuation: Analyst expectations also contribute to the valuation of NVIDIAs stock. Expectations of robust future performance can lead to higher target prices and valuations, while expectations of weaker performance can result in lower valuations.

In conclusion, analyst expectations play a significant role during NVIDIA earnings time. They shape market sentiment, influence investment decisions, and contribute to the overall valuation of the companys stock. By understanding the dynamics between analyst expectations and NVIDIA's actual earnings results, investors can gain valuable insights into how the market perceives the company, enabling them to make more informed investment choices.

The market's reaction to NVIDIA's earnings announcement is a critical component of "NVIDIA earnings time" because it provides insights into investor attitudes and the general perception of the companys financial achievements.

A positive market reaction, typically signified by an increase in NVIDIAs stock price, generally suggests that the company has exceeded market forecasts and that investors are optimistic about its future. This optimistic sentiment can stem from factors such as significant revenue growth, improved profitability, and a favorable outlook for the upcoming quarter.

Conversely, a negative market reaction, reflected by a decline in NVIDIAs stock price, implies that the company has underperformed against expectations or that investors harbor concerns regarding its future. Such negative feelings may arise from aspects like lower-than-expected revenue, decreasing gross margins, or a more cautious outlook for the forthcoming quarter.

Comprehending the market's response to NVIDIA's earnings announcement is crucial for investors. It provides valuable information about the markets overall assessment of the companys performance and future prospects. By analyzing the market reaction in conjunction with the companys financial results, investors can make better-informed investment decisions and evaluate the companys overall financial health and competitive positioning.

Question 1: What is the significance of NVIDIA's earnings time?

Answer: NVIDIA's earnings time is a critical event that provides crucial insights into the companys financial achievements, revenue generation, and overall profitability. It serves as a benchmark for investors, analysts, and the broader financial community to evaluate the company's financial health and to make well-informed investment decisions.

Question 2: What are some key aspects to consider during NVIDIA's earnings time?

Answer: Key factors to consider during NVIDIA's earnings time include revenue, earnings per share (EPS), gross margin, forward-looking guidance, analyst expectations, and the markets reaction. Taken together, these elements offer a comprehensive view of NVIDIAs financial status and potential trajectory.

Summary: NVIDIA's earnings time is a high-value event that provides investors, analysts, and other financial stakeholders with essential information for assessing the company's financial standing and making sound investment choices. Comprehending the importance and key aspects of NVIDIA's earnings time is essential for gaining insights into the companys overall performance and future prospects.

NVIDIA's earnings time provides a panoramic perspective on the company's financial performance and its prospects. Analyzing key elements such as revenue, earnings per share, gross margin, forward-looking guidance, analyst expectations, and market reactions allows investors and analysts to gain invaluable insights into NVIDIA's financial health, its competitive positioning, and its overall strategic vision.

Understanding NVIDIA's earnings time is indispensable for making informed investment decisions. The information provided during earnings time enables investors to evaluate the company's ability to generate revenue, manage costs effectively, and deliver profitable growth. Staying informed about NVIDIA's earnings outcomes and the subsequent market reactions is crucial for making sound investment decisions that align with specific financial objectives.

- Decoding T33n What It Is Why It Matters Translation Guide

- Exploring Donnie Van Zant The Legacy Of A Southern Rock Icon

Nvidia Earnings 2024 Time Vita Aloysia

Nvidia Earnings 2024 Time Limit Lilla Patrice

Nvidia Earnings 2024 Time Today Heida Kristan