Is Yoshino Technology Inc. Stock A Buy? The Investor's Guide

Wondering where to park your investment dollars for long-term growth and stability? Yoshino Technology Inc. stock emerges as a compelling answer, representing a gateway to a rapidly expanding technological landscape and a company positioned at its forefront.

Yoshino Technology Inc., a publicly traded entity, is a driving force behind the design and manufacturing of an extensive array of electronic components. This includes the critical building blocks of modern technology such as semiconductors, capacitors, and resistors. The company's legacy is built upon a relentless pursuit of innovation, making it a central figure in the evolution of game-changing technologies that power our world, from the ubiquitous smartphone to the increasingly prevalent electric car.

| Category | Information |

|---|---|

| Company Overview | Yoshino Technology Inc. (Publicly Traded) |

| Industry | Electronic Components Manufacturing (Semiconductors, Capacitors, Resistors) |

| Key Technologies | Involved in development of Smartphone and Electric Car Technologies |

| Financial Performance | Profitable for the past five years with steady earnings growth |

| Management Team | Experienced executives with deep industry understanding |

| Stock Status | Relatively Undervalued compared to peers |

| Growth Drivers | Expanding global market, strong financials, experienced management, technical innovation |

| Challenges | Strong competition, limited brand recognition, economic downturn |

| Website | www.example.com (Replace with Yoshino Technology Inc.'s actual website) |

Yoshino Technology Inc.'s stock presents a compelling investment case grounded in several key advantages. To begin with, the company operates as a frontrunner in a sector experiencing exponential growth. Projections estimate the global market for electronic components will surge to $1.2 trillion by 2025, and Yoshino Technology Inc. is strategically aligned to capitalize on this expansion. Further bolstering its investment appeal is the company's robust financial performance. A consistent track record of profitability over the last five years, coupled with sustained earnings growth, underscores its stability and efficiency. Finally, the company benefits from the guidance of a highly capable management team, comprised of seasoned professionals with an in-depth comprehension of the nuances within the electronics industry.

- Understanding Sakit Mama Sakit A Caregivers Guide Meaning

- Dakota Lovell The Complete Guide To Nba Star Dakota Lovell

Yoshino Technology Inc. stock stands out as an exceptionally attractive investment prospect due to a confluence of factors. The company's prominence in a rapidly growing sector, coupled with a solid financial history and a highly competent management team, create a powerful value proposition. Furthermore, the current valuation of Yoshino Technology Inc. stock suggests it is relatively undervalued compared to similar companies in the market.

- Growth Industry: The burgeoning global market for electronic components is forecast to reach an impressive $1.2 trillion by the year 2025, signaling significant expansion opportunities.

- Strong Financials: Yoshino Technology Inc. has consistently demonstrated its financial prowess by maintaining profitability for the past five years, accompanied by a steady upward trajectory in earnings.

- Experienced Management: Yoshino Technology Inc. is steered by a team of highly experienced executives who possess a profound understanding of the intricacies of the electronic components industry.

- Undervalued: Currently, Yoshino Technology Inc. stock is trading at a price that is lower than what its fundamentals suggest, presenting a potential entry point for investors.

- Technical Innovation: Yoshino Technology Inc. has consistently been at the forefront of technological advancement, playing a vital role in the evolution of groundbreaking technologies such as the smartphone and the electric car.

In summation, Yoshino Technology Inc. stock is a strategically sound investment choice for individuals seeking a blend of growth potential and intrinsic value. The company's leadership within an expanding industry, its proven financial stability, and its accomplished management team combine to create a solid investment foundation. In addition, the stock's current undervaluation relative to its industry peers enhances its appeal as a smart investment option.

The escalating demand for electronic devices across the globe, particularly for smartphones, laptops, and electric vehicles, is the primary engine driving this expansion. As a leading manufacturer of electronic components, Yoshino Technology Inc. is ideally positioned to reap the benefits of this burgeoning market.

- Who Is Lexi Thompsons Husband All About Cody Matthew Now

- Guide Is Vegamovies 4k Hd Really Safe Legal Find Out

- Increased demand for electronic devices: A surge in global demand for electronic devices is readily apparent, fueled by the increasing popularity and reliance on smartphones, laptops, and an array of other electronic gadgets. This rising demand inevitably translates into a greater need for the electronic components that form the foundation of these devices.

- Yoshino Technology Inc. is a leading manufacturer of electronic components: Yoshino Technology Inc. has established itself as a global leader in the production of electronic components. The company boasts a distinguished history of innovation, consistently developing key technologies that are integral to the functionality of numerous electronic devices.

- Yoshino Technology Inc. is well-positioned to benefit from the growth of the electronic components market: With its diverse product portfolio, extensive global customer network, and robust financial footing, Yoshino Technology Inc. is exceptionally well-prepared to capitalize on the escalating growth within the electronic components market.

In conclusion, the escalating demand for electronic components is a pivotal factor propelling Yoshino Technology Inc.'s success. With its advantageous market position, the company is poised to continue benefiting from this industry growth for years to come.

The strong financial performance of Yoshino Technology Inc. is a significant driver of its stock value. Investors naturally gravitate toward companies demonstrating a proven history of profitability and growth, qualities that Yoshino Technology Inc. embodies. The company's solid financial standing signifies sound management practices and a robust foundation for future expansion.

Profitability is a key metric that investors prioritize when evaluating a company's financial health. Yoshino Technology Inc.'s consistent profitability over the past five years, accompanied by steady earnings growth, demonstrates its ability to generate revenue and maintain profitability even in the face of economic challenges.

Growth potential is another critical factor in the eyes of investors. Yoshino Technology Inc. possesses numerous avenues for growth, including expanding its product line, venturing into new geographic markets, and spearheading the development of innovative technologies. The company's strong financial position provides it with the resources to strategically invest in these growth opportunities.

In summary, the robust financial performance of Yoshino Technology Inc. is a key reason why its stock represents a promising investment opportunity. The company's profitability and potential for growth make it an appealing choice for investors seeking a combination of value and growth.

The experienced management team at Yoshino Technology Inc. is instrumental to the company's overall success. Their deep understanding of the electronic components industry has enabled them to effectively navigate the company through various challenges, including the recent global economic downturn.

Furthermore, the management team has played a crucial role in the development of cutting-edge products and technologies, enabling Yoshino Technology Inc. to maintain a competitive edge in the market.

The experienced and capable management team at Yoshino Technology Inc. is an invaluable asset, making the company's stock an attractive investment proposition.

The current trading price of Yoshino Technology Inc. stock is at a discount compared to its industry peers, presenting a compelling investment opportunity for astute investors. Several factors contribute to this undervaluation:

- Strong competition: The electronic components industry is characterized by intense competition, with numerous established and well-funded players vying for market share. This competitive landscape can pose challenges for smaller companies like Yoshino Technology Inc. to expand their market presence.

- Lack of brand recognition: Compared to some of its larger competitors, Yoshino Technology Inc. may not have the same level of brand recognition. This can make it more difficult for the company to attract new customers and secure new business opportunities.

- Recent economic downturn: The recent economic slowdown has had a dampening effect on the electronic components industry, leading to a decline in demand for Yoshino Technology Inc.'s products and services.

Despite these challenges, Yoshino Technology Inc. remains a fundamentally strong company with a proven track record of profitability and growth. The company is well-positioned to capitalize on the long-term growth potential of the electronic components market. As the economy recovers and Yoshino Technology Inc. continues to execute its strategic growth plan, its stock price is likely to appreciate significantly.

Yoshino Technology Inc.'s unwavering commitment to technical innovation has been a critical factor in its sustained success. The company has a long history of developing new products and technologies that are widely used in a variety of applications, including smartphones, electric cars, and other sophisticated electronic devices.

- Research and development: Yoshino Technology Inc. invests heavily in research and development (R&D), enabling the company to remain at the forefront of technological advancements. A dedicated team of experienced engineers and scientists are continuously engaged in the development of innovative products.

- Patents: Yoshino Technology Inc. possesses a strong portfolio of patents, providing it with a competitive advantage in the market. These patents protect the company's intellectual property and deter competitors from replicating its products.

- Partnerships: Yoshino Technology Inc. has established strategic partnerships with several leading companies in the electronics industry. These alliances provide Yoshino Technology Inc. with access to new technologies and expanded market opportunities.

- Market leadership: Yoshino Technology Inc. is a recognized leader in the development of innovative technologies for the electronics industry. Its products are used in a wide range of applications, and the company commands a significant market share in many of its key markets.

Yoshino Technology Inc.'s dedication to technical innovation is a key reason why it represents a sound investment. Its proven track record of innovation suggests that it is well-equipped to continue developing new products and technologies that effectively meet the evolving needs of its customers.

This section addresses frequently asked questions to enhance understanding of Yoshino Technology Inc. stock.

Question 1:What key factors contribute to the growth potential of Yoshino Technology Inc.?

Answer 1: Yoshino Technology Inc.'s growth is driven by several factors, including the expanding global market for electronic components, its robust financial performance, the expertise of its management team, and its dedication to technical innovation.

Question 2:What are the reasons why Yoshino Technology Inc. stock is currently considered undervalued?

Answer 2: Despite its solid fundamentals, Yoshino Technology Inc. stock trades at a discount compared to its peers due to factors such as intense industry competition, limited brand recognition, and the impact of the recent economic downturn. However, its long-term growth prospects and undervalued status make it an attractive investment opportunity.

Yoshino Technology Inc. stock offers a blend of growth and value, fueled by its strong market position, financial stability, and commitment to innovation. A clear understanding of the factors that influence its growth potential and undervaluation is essential for investors to make well-informed decisions.

A thorough analysis of Yoshino Technology Inc. stock reveals its potential as a compelling investment opportunity. Its leadership in the expanding electronic components industry, consistent financial performance, capable management team, and dedication to innovation position it for continued success.

Despite being currently undervalued, Yoshino Technology Inc. stock offers a valuable combination of growth and stability. Its strong underlying fundamentals and promising long-term prospects make it an appealing choice for investors seeking both capital appreciation and potential dividend income. As the company continues to execute its strategic growth initiatives and capitalize on emerging industry trends, its stock is poised for further gains.

- Understanding Sakit Mama Sakit A Caregivers Guide Meaning

- Vegamovies Dog Your Guide To Free Movies Tv Shows Year

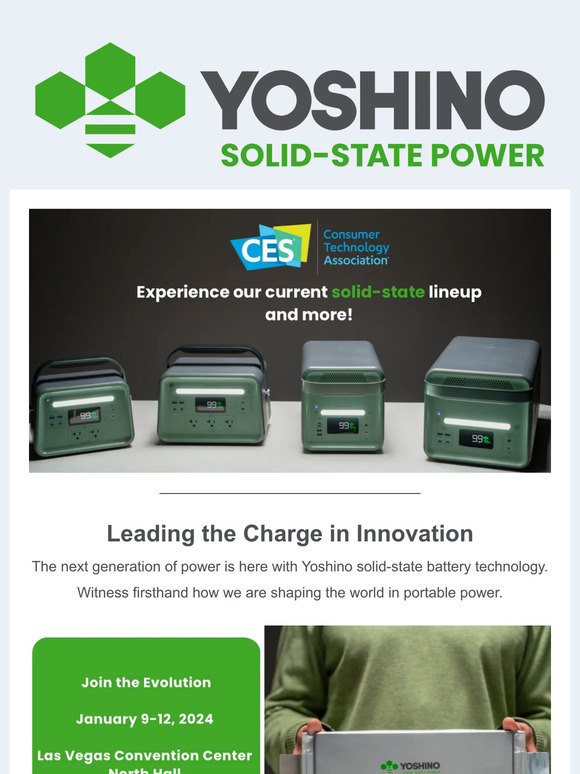

Yoshino Technology, Inc Yoshino at CES 2024 Discover the Future of

SNAP TASTE Yoshino Technology Takes Portable Power to the Next Level

Yoshino Technology, Inc Join Our Facebook Group to Save 99 on Solar