VOO Vs VTI: Key Differences & Which ETF Is Best? [2024 Guide]

Confused about where to park your investment dollars? The choice between VOO and VTI isn't just a matter of preference; it's a strategic decision that hinges on your unique financial DNA. Understanding the nuances between these two Exchange Traded Funds can significantly impact your portfolio's growth and stability.

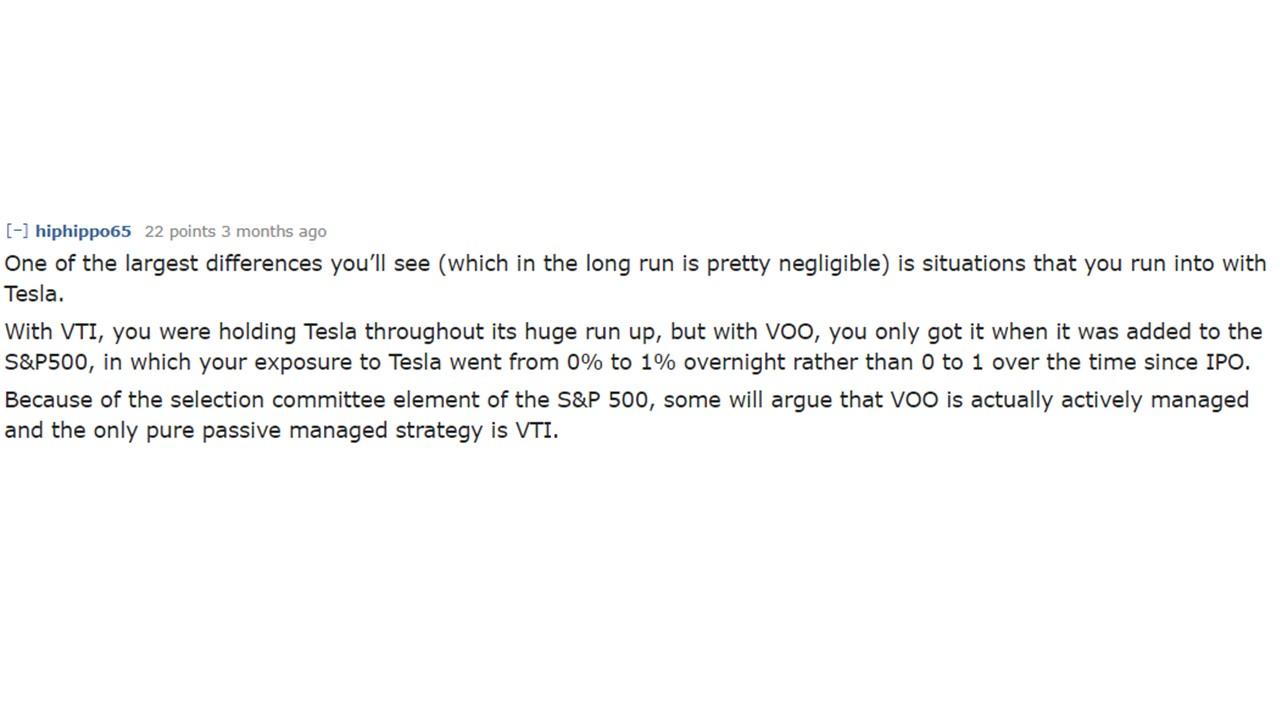

VOO and VTI stand as twin titans in the realm of exchange-traded funds (ETFs), each a beacon guiding investors through the complex currents of the stock market. While both ETFs offer broad exposure to the U.S. equity landscape, a closer examination reveals pivotal distinctions that can influence investment outcomes.

| Category | VOO (Vanguard S&P 500 ETF) | VTI (Vanguard Total Stock Market ETF) |

|---|---|---|

| Investment Objective | Tracks the S&P 500 Index | Tracks the entire U.S. stock market |

| Portfolio Composition | 500 Largest U.S. Companies | All U.S. Stocks (Large, Mid, Small-Cap) |

| Expense Ratio | 0.03% | 0.03% |

| Dividend Yield (as of Oct 2024) | 1.5% (Variable) | 1.4% (Variable) |

| Holdings | Approximately 500 | Approximately 4,000 |

| Top Sector Allocation | Technology | Technology |

| Risk Profile | Moderate | Moderate |

| Turnover Rate | 2% | 3% |

- Pineapplebrat Fanfix What Fans Should Know Is It Safe

- Roberta Colindrez Exploring The Life Career Of The Star

VTI Versus VOO ETF Tax Efficiency, Explained

VTI Versus VOO ETF Tax Efficiency, Explained

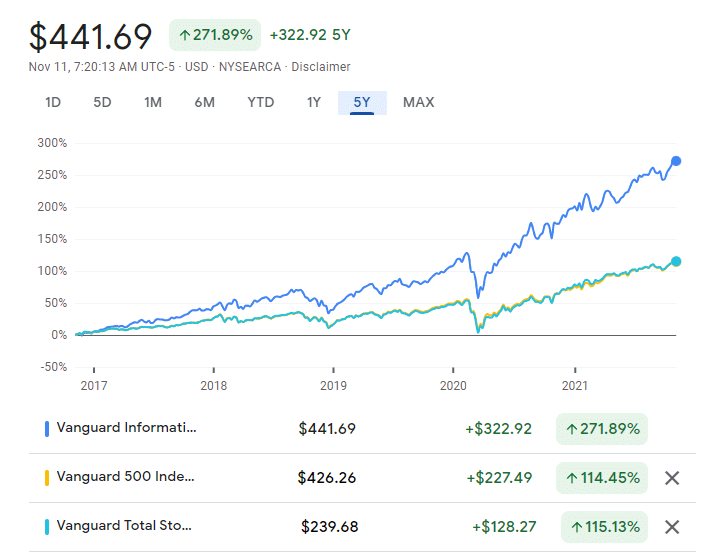

VTI vs VOO vs VGT Here's How They Differ (2022)