Decoding Movie Vega: A Trader's Guide To Option Volatility

Are you truly prepared for the wild swings of the options market? You absolutely must understand "movie vega" if you want to navigate the turbulent waters of option trading with any degree of confidence. It is an indispensable tool for managing risk.

In the lexicon of options trading, the term "movie vega" surfaces as a critical concept for sophisticated investors. It represents a quantifiable measure of an option's price sensitivity relative to changes in the implied volatility of the underlying asset. Formally, it's calculated as the partial derivative of the option price with respect to the volatility of that underlying asset, providing a glimpse into how an option's value will react to market jitters.

The profound significance of movie vega lies in its utility for hedging against volatility risk. Picture this: an astute investor anticipates a surge in the underlying asset's volatility. To mitigate potential losses on other investments, they can strategically acquire an option boasting a positive vega. This move essentially offsets the negative impact of heightened volatility, offering a shield against market turbulence. Its about understanding the levers and pulleys of the market, and using them to your advantage.

- Dakota Lovell The Complete Guide To Nba Star Dakota Lovell

- Loving Aunt Free Episodes Online Download Is It Legit

| Attribute | Details |

| Concept | Movie Vega |

| Definition | Sensitivity of an option's price to changes in the volatility of the underlying asset. |

| Calculation | Partial derivative of the option price with respect to volatility. |

| Application | Hedging against volatility risk and strategic option trading. |

| Impact Factors | Time to expiration, strike price, interest rates, dividends. |

| Developer | Fischer Black and Myron Scholes (Conceptual Basis) |

| Reference | Investopedia - Vega |

Movie vega stands as an essential instrument for investors who prioritize robust risk management. A firm grasp of how vega functions empowers investors to make well-informed decisions regarding the options they buy or sell. It transforms what could be a speculative gamble into a calculated maneuver.

The advantages of incorporating movie vega into your trading strategy are threefold: reduced risk of losses, improved portfolio performance, and increased flexibility in adapting to market changes. These benefits arent merely theoretical; they translate directly into tangible results for those who wield the tool effectively.

The genesis of the movie vega concept can be traced back to the early 1970s, thanks to the groundbreaking work of Fischer Black and Myron Scholes. As they diligently crafted a model for pricing options, they made a pivotal discovery: the price of an option wasn't solely dictated by the underlying asset's price; it was also heavily influenced by the asset's volatility. This revelation would reshape the landscape of options trading forever.

- Jessica Kinley Onlyfans Leaks What You Need To Know Now

- Decoding Zodabuz7 Sophie Rain Spiderman Why Its Trending

The Black-Scholes model, born from their insights, continues to be a cornerstone for pricing options to this day. Yet, the model has undergone continuous refinement over the years, with the addition of movie vega being a particularly significant enhancement. It's a testament to the dynamic nature of finance, where innovation constantly builds upon existing foundations.

Movie vega, in essence, is a barometer of how sensitive an option's price is to the ebb and flow of volatility in the underlying asset. Its calculation involves determining the partial derivative of the option's price with respect to this volatility. The importance of movie vega stems from its application in hedging against the inherent perils of volatility risk.

- Measures price sensitivity to volatility changes.

- Calculated as the partial derivative of option price with respect to volatility.

- Used for hedging against volatility risk.

- Impacts option pricing and trading strategies.

- Influenced by factors like time to expiration and strike price.

- Requires careful consideration in options trading.

In the grand scheme of things, movie vega acts as a compass, guiding traders through the choppy waters of options trading. It provides a quantifiable measure of how volatility shifts will impact option prices. Mastering its use can significantly bolster risk management practices and ultimately lead to more favorable trading outcomes.

Movie vega quantifies the extent to which an option's price responds to fluctuations in the volatility of the underlying asset. In simpler terms, it gauges how much an option's price will wiggle for every nudge in the asset's volatility. Understanding this relationship is paramount for anyone venturing into the realm of options trading.

- Facet 1: Impact on Option Pricing

Movie vega acts as a central cog in the machinery of option pricing. Options that exhibit a higher vega value are inherently more sensitive to volatility shifts, meaning their prices will dance more vigorously in response to any volatility change. It's the volatility amplifier in the option's DNA.

- Facet 2: Role in Option Trading Strategies

Savvy traders wield movie vega to craft strategies aimed at capitalizing on volatility's movements. For instance, a trader anticipating a spike in an asset's volatility might strategically purchase an option with a high vega, positioning themselves to reap potential profits from the impending price surge.

- Facet 3: Hedging Against Volatility Risk

The shield of movie vega can be deployed to safeguard against the potential devastation of volatility risk. By selectively acquiring options with a negative vega, an investor can effectively cushion their portfolio against the blow of increased volatility, minimizing potential losses.

- Facet 4: Considerations in Options Trading

Before jumping into the fray of options trading, it's crucial to acknowledge the pivotal role of movie vega. Traders must meticulously assess the vega of the options they contemplate, fully understanding how it will sway the option's price in response to the ever-shifting tides of volatility. Its a vital piece of the puzzle.

Movie vega provides a quantifiable measure of an option's sensitivity to volatility changes. It serves as a critical instrument for devising option trading strategies, hedging against volatility-related risks, and ultimately, making well-informed trading decisions.

The mathematical heartbeat of movie vega lies in its calculation as the partial derivative of the option's price with respect to volatility. In essence, it gauges the rate at which the option's price will fluctuate in response to a given shift in volatility. This intricate relationship provides valuable insights for discerning traders.

The significance of movie vega resides in its capacity to empower traders with a clear understanding of how an option's price will react to the unpredictable dance of volatility. This knowledge is the cornerstone of making astute trading choices, separating the informed from the reckless.

To illustrate, imagine a trader forecasting an upswing in the volatility of an underlying asset. In such a scenario, they might strategically purchase an option with a high movie vega, positioning themselves to benefit from the anticipated surge in volatility and potentially reap substantial profits.

Conversely, a trader who anticipates a decline in the volatility of an underlying asset might opt for an option with a low movie vega. This defensive maneuver serves to safeguard their investment from potential losses stemming from the anticipated decrease in volatility. It's all about playing the market's ebbs and flows with precision.

In summation, movie vega emerges as a valuable ally for traders aiming to navigate the complexities of option trading with a keen understanding of volatility's influence. It's a tool that elevates trading from a game of chance to a calculated endeavor.

Movie vega stands as a gauge of an option's price sensitivity when confronted with fluctuations in the volatility of the underlying asset. Its essence lies in its ability to quantify how an option's price will respond to the market's unpredictable swings.

For example, should an investor anticipate an upswing in the volatility of an underlying asset, they might strategically acquire an option with a positive movie vega. This proactive move allows them to potentially profit from the expected increase in volatility.

Conversely, if an investor foresees a decline in the volatility of an underlying asset, they might opt for an option with a negative movie vega. This protective stance aims to shield their investment from potential losses arising from the anticipated decrease in volatility.

Ultimately, movie vega equips investors with a powerful tool to effectively manage their risk exposure in the face of market volatility. It transforms risk management from a guessing game into a calculated strategy.

Movie vega wields considerable influence over option pricing and the formulation of trading strategies. It serves as a yardstick, measuring the sensitivity of an option's price to the ever-shifting landscape of volatility in the underlying asset. A comprehensive understanding of movie vega is indispensable for traders seeking to make sound decisions and craft effective trading strategies.

Options that exhibit a higher movie vega are inherently more responsive to volatility changes, leading to significant price swings. Traders can capitalize on this sensitivity by strategically purchasing options with high movie vega when they foresee an increase in volatility. Conversely, they can sell options with high movie vega when they anticipate a decline in volatility.

For example, if a trader believes a stock's volatility is poised to surge, they might strategically purchase a call option characterized by a high movie vega. As volatility escalates, the option's price would likely rise, potentially generating substantial profits for the astute trader.

In conclusion, movie vega plays an indispensable role in shaping option pricing and guiding trading strategies. By embracing and incorporating movie vega into their analytical framework, traders can sharpen their decision-making prowess, effectively manage risk, and potentially achieve more favorable trading outcomes. It's the secret ingredient to successful options trading.

Movie vega is a multifaceted concept influenced by a range of factors, including the time remaining until expiration and the option's strike price. Grasping how these elements affect movie vega is paramount for options traders seeking to navigate the market with precision.

- Facet 1: Time to Expiration

Time to expiration refers to the countdown until an option contract's final curtain call. As the expiration date draws nearer, movie vega generally experiences an upward trend. This phenomenon arises because the option's price becomes increasingly sensitive to volatility changes as it edges closer to its moment of truth.

- Facet 2: Strike Price

Strike price defines the price at which an option can be exercised, effectively setting the stage for potential gains or losses. Options with strike prices that are far removed from the underlying asset's current price typically exhibit higher movie vega values compared to those with strike prices that closely mirror the asset's value. This is due to the fact that out-of-the-money options are inherently more susceptible to volatility fluctuations.

In summary, time to expiration and strike price stand as two pivotal factors influencing movie vega. Traders must remain vigilant in their assessment of these factors to make informed trading decisions, maximizing their potential for success in the options market.

Understanding movie vega is not merely beneficial; it's absolutely essential for options traders. It directly impacts the pricing and potential profitability of their trades. A meticulous consideration of movie vega empowers traders to make judicious decisions and formulate effective trading strategies that both manage risk and enhance returns.

Traders must evaluate an option's movie vega in conjunction with a multitude of other factors, including prevailing market conditions, their individual risk tolerance, and their specific trading objectives. Options with high movie vega can amplify gains in volatile markets, but they can also magnify losses if volatility unexpectedly subsides. Conversely, options with low movie vega offer a more stable profile, providing less sensitivity to volatility changes, but potentially limiting profit potential.

To illustrate, consider a trader who anticipates a surge in market volatility. Such a trader might strategically acquire an option with a high movie vega, aiming to capitalize on the anticipated price surge. However, if volatility remains subdued or unexpectedly declines, the option's value could plummet, resulting in losses for the trader.

In conclusion, a thorough consideration of movie vega is indispensable for options traders navigating the intricacies of volatility. It equips them with the knowledge needed to make informed trading decisions that align with their risk appetite and financial aspirations. It's the key to unlocking success in the options market.

This section endeavors to dispel common questions and address misconceptions surrounding movie vega, providing clear and informative answers to foster a deeper understanding of this critical concept.

Question 1: What exactly is movie vega?

Answer: At its core, movie vega quantifies the sensitivity of an option's price to changes in the volatility of the underlying asset. It essentially measures the degree to which the option's price will fluctuate in response to a given change in volatility.

Question 2: Why is movie vega important for options traders?

Answer: Understanding movie vega is of paramount importance for options traders because it equips them with the knowledge needed to assess the impact of volatility on their trades. By factoring in movie vega, traders can make well-informed decisions about which options to buy or sell and how to effectively manage their risk exposure.

In summary, movie vega serves as a fundamental concept in options trading, providing valuable insights into the intricate relationship between option prices and volatility. By incorporating movie vega into their analytical toolkit, traders can enhance their decision-making process and ultimately improve their trading outcomes. It's the compass that guides them through the sometimes treacherous waters of the options market.

- Decoding Nekololisama What You Need To Know Anime Guide

- Breaking Are Greg Gutfeld And Jesse Watters Really Friends Find Out

Street Fighter II Movie Vega Key Art by michaelxgamingph on DeviantArt

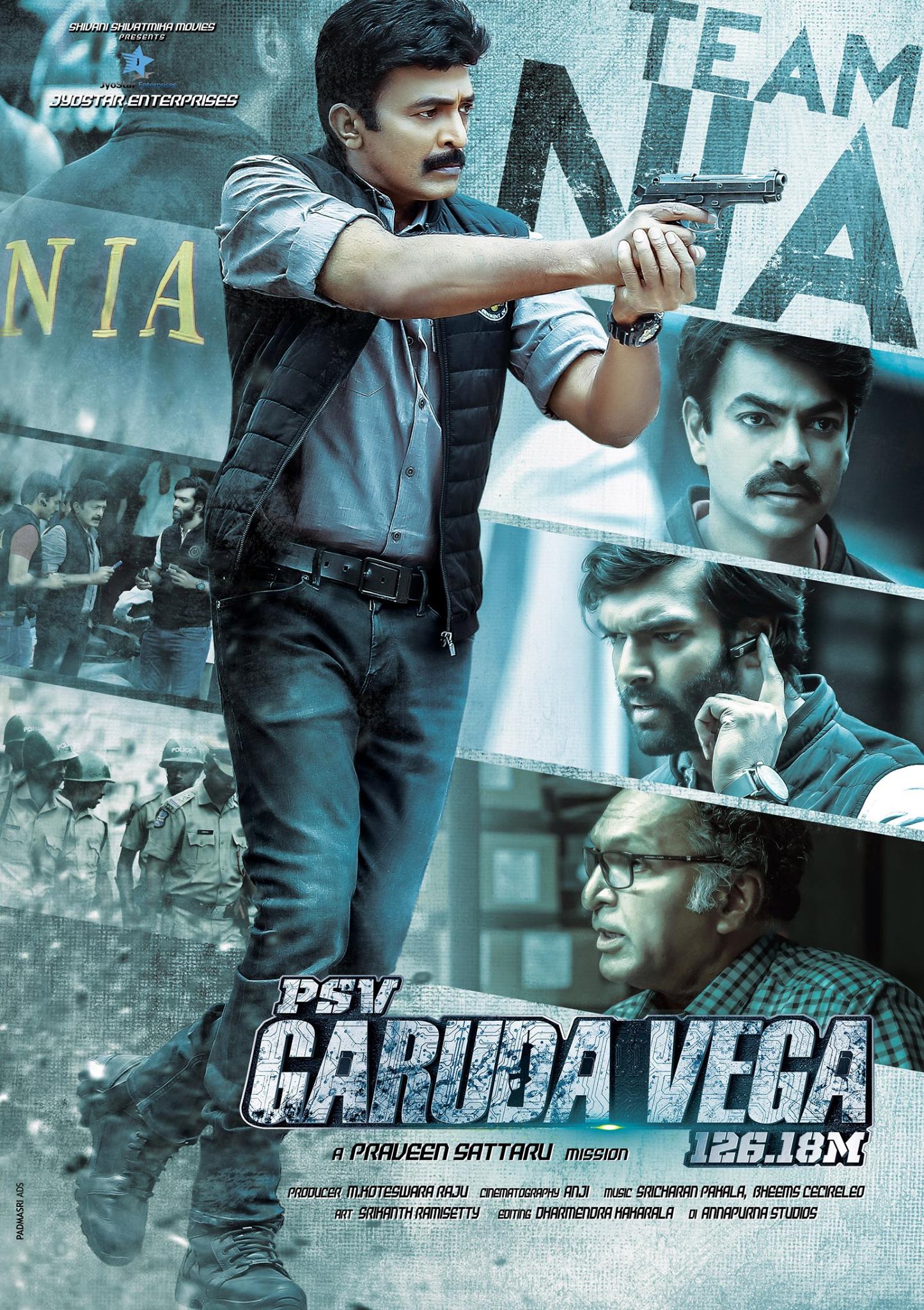

Rajasekhar PSV Garuda Vega Movie First Look ULTRA HD Posters WallPapers

Vega The Unofficial Street Fighter Movie Fansite